Both a home warranty and a homeowners insurance (or home insurance) are designed to protect the assets of homeowners: a home, along with its systems and appliances, are generally the most valuable assets for American families. Both coverages are designed to protect them.

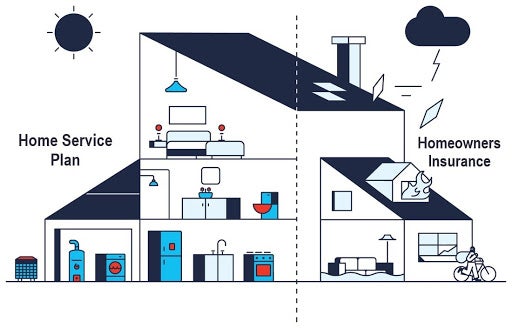

Home warranties generally cover the home systems, major appliances, and some of the personal belongings (such as electronics) of homeowners while home insurance coverage is designed to cover the financial losses associated with damage or loss of a property you own.

What’s the Difference Between Homeowners Insurance and a Home Warranty?

The main difference between a home warranty and home insurance is quite simple. Homeowners insurance—or house insurance, as it’s more casually called—typically protects your home from events like fire, smoke, theft, fallen trees, or damage caused by weather or a natural disaster.

A home warranty plan protects your budget when covered appliances and home systems break down due to normal wear and tear. You can also check out our article on what is a home warranty to learn more.

In other words, homeowners insurance covers those events that are unlikely to happen but would often entail a great cost. This is why a home insurance premium can go up if you live in an area prone to flooding or other extreme weather events. On the other hand, home warranty companies offer peace of mind on those events that you're the most likely to experience: when appliances break, when plumbing gets clogged, or the AC stops working. In other words, home warranty coverage helps reduce the financial burden and hassle when unexpected breakdowns occur.

Home warranty coverage can potentially save you hundreds or even thousands of dollars, and it helps you avoid the headache of finding a trusted service Pro to make the repair. For American Home Shield members, a home warranty includes coverage of major components and parts of up to 23 important appliances and home systems, home maintenance services like HVAC tune-ups, and optional add-on coverage options to customize your home warranty plan. We provide plans for homeowners like you who have systems and appliances and want to avoid unexpected out-of-pocket costs.

Take a look at this side-by-side comparison of homeowners insurance vs. a home warranty.

| Home Warranty/Home Service Plan: Covers things that will happen | Homeowners Insurance: Covers things that might happen |

| HVAC Stops Working | Theft |

| Water Leaks | Fire Damage |

| Dishwasher Stops Working | Storm Damage |

| Toilet Overflows | Floods |

What is Homeowners Insurance?

Homeowners' insurance coverage typically includes any accidental damage to your home and belongings due to theft, storms, fires, and some natural disasters. There are four primary areas covered under a homeowners insurance policy:

- The interior of your home

- The exterior of your home

- Personal property in case of theft, loss, or damage

- General liability that can arise when a person is injured while on your property

How Much is Homeowners Insurance?

A home insurance policy is usually mandatory, and a bank will generally require you to obtain one before issuing a mortgage on a home. In terms of typical homeowners insurance cost, the policy is renewed yearly, and its average annual cost is roughly $1,312; though, this cost varies widely from state to state. All home insurance policies offer a deductible, which you'll pay when your claim is approved. The policy will then take care of any additional costs. Of course, you’ll want to do your research when it comes to home insurance comparisons, as different home insurance companies offer different rates and deductible requirements.

How Does Homeowners Insurance Work?

So, for instance, say you purchase homeowners insurance, and a pipe breaks and floods your kitchen. An insurance adjuster will come to your home and fill out a claim to repair or replace any damaged items in your home. Once the claim is approved, the insurance company will deduct the amount of your deductible and issue you a payment for the rest of the balance to repair your home. This deductible can also assist in lowering your yearly policy premium. The higher your deductible, the lower your yearly house insurance policy will cost. The National Association of Insurance Commissioners is a terrific resource for more information on home insurance, such as buying homeowners insurance and understanding what is not covered by homeowners insurance.

Homeowners insurance generally provides liability protection. This means that in case of third parties being affected by elements of your property (for example, a branch of one of your trees damaging a neighbor's house) your personal liability is limited and the homeowners' insurance policies can protect you.